4 Simple Techniques For Broker Mortgage Fees

Wiki Article

Broker Mortgage Fees Fundamentals Explained

Table of ContentsThe Single Strategy To Use For Mortgage BrokerMortgage Broker Job Description for BeginnersSee This Report about Mortgage Broker MeaningGetting The Broker Mortgage Fees To WorkMortgage Broker Assistant Job Description Fundamentals ExplainedThe Best Guide To Broker Mortgage MeaningExcitement About Mortgage Broker AssociationThe Ultimate Guide To Broker Mortgage Calculator

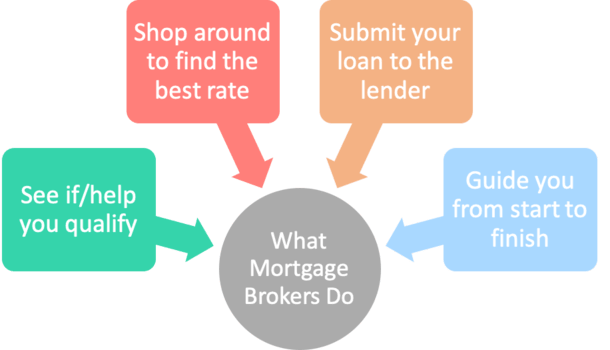

What Is a Home mortgage Broker? The mortgage broker will certainly function with both events to obtain the individual accepted for the financing.A mortgage broker usually functions with many various loan providers as well as can provide a selection of financing options to the consumer they function with. The broker will certainly gather info from the individual as well as go to several loan providers in order to find the finest possible funding for their customer.

All About Mortgage Broker Meaning

All-time Low Line: Do I Required A Home Mortgage Broker? Collaborating with a home loan broker can conserve the consumer time as well as initiative throughout the application procedure, and potentially a great deal of cash over the life of the financing. Additionally, some lending institutions work exclusively with home loan brokers, indicating that borrowers would certainly have access to lendings that would certainly otherwise not be offered to them.It's crucial to analyze all the charges, both those you might have to pay the broker, along with any costs the broker can aid you stay clear of, when evaluating the decision to work with a home mortgage broker.

The Basic Principles Of Broker Mortgage Fees

You have actually probably heard the term "home loan broker" from your realty representative or good friends that've purchased a house. However exactly what is a home loan broker and what does one do that's various from, say, a finance policeman at a bank? Nerd, Purse Overview to COVID-19Get responses to concerns about your home mortgage, traveling, funds and also preserving your assurance.What is a home mortgage broker? A mortgage broker acts as an intermediary between you and prospective loan providers. Mortgage brokers have stables of lending institutions they function with, which can make your life simpler.

The Definitive Guide to Broker Mortgage Fees

Just how does a home loan broker get paid? Home loan brokers are usually paid by lending institutions, sometimes by debtors, but, by regulation, never both. That regulation the Dodd-Frank Act additionally restricts home loan brokers from billing concealed fees or basing their compensation on a borrower's rate of interest. You can additionally pick to pay the home loan broker on your own.What makes home loan brokers various from funding policemans? Finance policemans are staff members of one lender that are paid set wages (plus bonuses). Funding policemans can compose just the kinds of fundings their employer chooses to use.

How Mortgage Broker Association can Save You Time, Stress, and Money.

Mortgage brokers might have the ability to provide consumers access to a broad option of finance kinds. 4. Is a home loan broker right for me? You can save time by making use of a home loan broker; it can take hrs to apply for preapproval with different lenders, then there's the back-and-forth interaction entailed in underwriting the lending as well as making sure the deal remains on track.When picking any kind of loan provider whether through a broker or straight you'll want to pay interest to lending institution costs. Specifically, ask what costs will show up on Web page 2 of your Financing Price quote form in the Loan Expenses section under "A: Origination Charges." Then, take the Car loan Quote you receive from each lending institution, position them alongside and compare your passion price and also all of the charges and closing costs.

Mortgage Broker Vs Loan Officer for Beginners

5. Exactly how do I choose a home loan broker? The ideal way is to ask friends and also loved ones for references, but make certain they have in fact used the broker and aren't simply dropping the name of a previous college flatmate or a distant colleague. Learn all you can regarding the broker's services, communication design, degree of expertise and also strategy to customers.

How Mortgage Broker Job Description can Save You Time, Stress, and Money.

Competition and also house costs will affect just how much home loan brokers get paid. What's the difference between a home mortgage broker and a car loan officer? Funding policemans work for one lending institution.

Getting The Mortgage Broker Salary To Work

Purchasing a brand-new house is among the most intricate events in an individual's life. Properties vary greatly in terms of style, features, school area and, naturally, the always important "place, location, place." The home loan application procedure is a complicated element of the homebuying procedure, especially for those without past experience.

Can identify which concerns could develop difficulties with one lender versus an additional. Why some customers avoid home loan brokers In some cases homebuyers really feel much more comfortable going straight to a large bank to protect their financing. In that situation, customers ought to at the very least speak with a broker in order to understand every one of their options Check This Out concerning the kind of financing and the available rate.

Report this wiki page